20182019 Malaysian Tax Booklet Personal Income Tax. If planned properly you can save a significant amount of taxes.

T20 M40 And B40 Income Classifications In Malaysia

Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

. Details of Tax Revenue - Malaysia Customise. Going for Growth 2019. 20182019 Malaysian Tax Booklet 21 year and in any 3 of the 4 immediately.

However with the self dependent tax. On the First 50000 Next 20000. 13 rows 28.

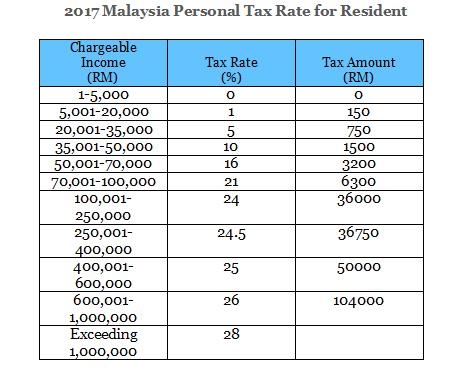

Going for Growth Cut-off date. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Malaysia offers a limited tax relief of RM 3000 for those making alimony payments towards their husband or wife.

The Annual Malaysia Tax Calculator is a. Video How to file your personal income tax in Malaysia as an expat 2019. If youre married you might be eligible for a tax relief not unlike that for dependents.

Calculations RM Rate TaxRM 0 - 5000. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. The amount of tax relief 2019 is determined according to governments graduated scale.

A quick and efficient way to compare annual salaries in Malaysia in 2019 review income tax deductions for annual income in Malaysia and estimate your 2019 tax returns for your Annual Salary in Malaysia. Calculate your annual take home pay in 2019 thats your 2019 annual salary after tax with the Annual Malaysia Salary Calculator. We highlight the personal income tax rate for foreigners and expats how to get your income tax number from Lembaga Hasil.

The fixed income tax rate for nonresident individuals is also increased to 30 percent. On the First 2500. A tax relief of RM 3500 also exists for those supporting a disabled spouse.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes.

One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable income of more than MYR 2000000. On the First 5000 Next 15000. December 2018 By country.

In our example a taxpayer would have been taxed about 10 of his total chargeable income of RM84300 if he had claimed no tax reliefs at all. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. A non-resident individual is taxed at a flat rate.

All-in average personal income tax rates at average wage by family type. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

On the First 20000 Next 15000. A video step-by-step guide to accompany our earlier post about how to file your personal income tax in Malaysia in 2019 as an expat or foreigner. On the First 70000 Next.

The system is thus based on the taxpayers ability to pay. Tax Relief Year 2019. On the First 35000 Next 15000.

Average personal income tax and social security contribution rates on gross labour income. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. Tax Rates for Individual Assessment Year 2019.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Lhdn Irb Personal Income Tax Relief 2020

Download Microfinanceindia Images For Free

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Everything You Need To Know About Running Payroll In Malaysia

Income Tax Malaysia 2018 Mypf My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Here S 5 Common Tax Filing Mistakes Made By Asklegal My